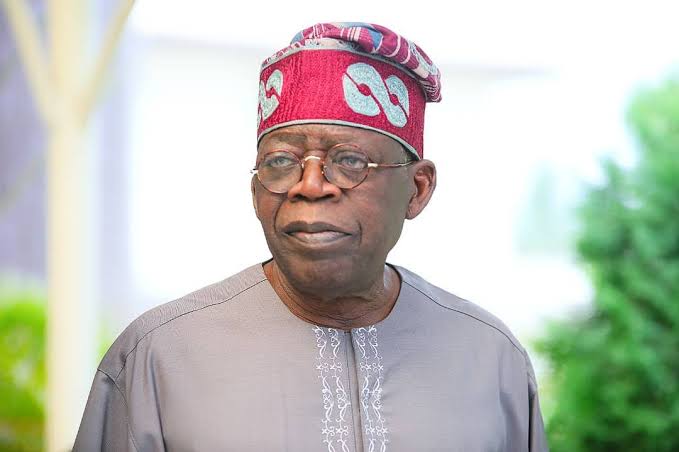

Opinion

A Time for Unity, A Time for Thought, A Time for Actions – Tinubu

Today (March 29) is my birthday. I thank God for giving me the life and time on earth he has provided me. He has blessed me beyond the ability of words to describe; I am more than cognizant of His great mercies toward me. I have much to be thankful for. However, this is not the moment for exuberant celebration or light talk on my part. At this moment, it is better that we confer in prudence and wisdom, one to another, so that we can better deal with that which seems eager to severely deal with us.

We have entered a sobering period. We face a challenge we cannot see but one that can find us all too easily. As individuals, this puts every one of us at a startling disadvantage. Each is rendered vulnerable by the reckless act of his neighbour. Each is made safer by the enlightened conduct of a stranger. The very nature of this assailant calls us toward greater unity and kindness.

In the normal push of our daily affairs, we tend to focus on what divides us. We are either APC, PDP or another political affiliation. One person is rich. Another is poor. There is the labourer then there is the boss. One person is of the north, another of the south, with both often acting as if the boundary between the two cannot be traversed. We are of different ethnic groups; these identities mean so much to us that we behave as if the affiliations are the very source of our humanity. In this, we tend to forget God. Even when we worship God, we divide ourselves in ways that too often bring violence to a way of life meant to bring peace and compassion.

But, the coronavirus is now here. If we carry forth in our usual ways, we may well carry ourselves into national disaster. Normal practices will not suffice. We all must do better lest we all fail and suffer the grave consequences of collective failure. We pray that this terrible cloud will pass from us. However, we must prepare for the possibility that it may linger to rain hard upon us.

For the past 11 years, a colloquium was held on my birthday. Each year, the colloquium gathered some of our best minds in both the public and private sectors. They would dissect and explore the weighty issues of the day in order to find solutions to the social, political and economic difficulties that confront our nation. However, the threat of the coronavirus obligated colloquium organizers to postpone the event; we did not want a large number of people gathered in a relatively compact physical space. This was a decision well taken.

It has been a custom at the colloquium that I offer a few comments pertaining to the issue at hand.

In the spirit of the colloquium, I offer these remarks today. In that coronavirus put a brake on the colloquium, I thought it proper to return the favour. I therefore tender these humble comments in hope they contribute to halting the spread and ill consequences of this dreadful sickness.

The foremost imperative is that we recognise that corona is here. We must cast aside the myths that we have comforted ourselves with these past weeks. We told ourselves this was not a black man’s disease. We took false comfort in this self-deception. Well, black people have contracted the ailment; black people have also died from it. We hoped that our hot climate would bake and destroy the virus. That wish now appears too optimistic. We even said our history in dealing with malaria and other tropical diseases granted us some type of immunity. Well, I doubt that immunity exists as there is no scientific evidence supporting this claim. If such an immunity exists, it is at most incomplete and so unreliable as to be of no avail to large segments of our population.

The rich cannot bargain with the disease or pay it off. It neither reads bank account statements nor is it intimidated by them. The poor, likewise, are subject to it for it has no mercy nor cares about one’s prior or present hardships. Neither does it seem to study geography. Northerner and Southerner are equally its prey. It will attack those who pray at the altar in church as well as those who face the Qiblah when praying in the mosque. To corona, we are all the same. Thus, to fight corona, we must treat each other the same, as brothers and sisters in one national family under one Heaven. For we are of one blood; this crisis is a stark warning that we must begin to act in consonance with that common humanity.

It is true that we and other African countries are among the nations thus far least affected. However, we must not think this means geography and climate have erected a protective shield on our behalf. At best, these things constitute a partial barrier that may have slowed but will not prevent the growing threat.

China and other Asian nations took drastic, wholesale action to thwart the viral spread. North America and Europe initially took small steps against the virus. Those did not work. Now they are fast implementing lockdowns of whole cities and closures of key segments of their economies.

We must be prepared to do the same, though it is alien to our communal culture and way of life. Let us be frank. The public health care systems of developed nations have been overwhelmed by this virus. They are running out of equipment and healthy doctors. Our public health care system is much smaller and less equipped than those in Europe and North America. We cannot afford to put undue pressure on our system because it cannot bear the great weight of a pandemic. Thus, it is incumbent on us to thoroughly implement and obey social safety and distancing techniques so that we halt the spread of the disease and keep hospitalisation to the barest possible minimum.

Second, limit your social contacts. Unless for necessary matters, one should not venture out. To purchase food is essential. To redo one’s hair or go to a bar for a drink are not.

Places like banks offer needed services such as cash withdrawals. But they should limit the number of customers in the bank at any given time. Supermarkets and grocers should do the same.

We should continue to postpone sporting events, weddings, and other large gatherings. Funerals, if they must take place, should be attended only by small numbers of family members.

While we put aside the large events for now, we must do better looking after our fellow man. Please check on a neighbour. Make sure the elderly near you are well and have food and water.

Use this moment to teach your children about compassion and the traditional values of care and concern that often get diluted in our rush toward modernity and growth.

Not only is the coronavirus a health and medical problem, it will bring heavy economic costs. China and the West face severe economic contractions. Cities are shuttered. Multiple industries have closed. Millions have suddenly been rendered jobless. Supply chains have busted. Economic activity is a fraction of what it was just a month ago. Deep recessions are forecasted. Some experts fear depression now tracks the world down. Governments worldwide are responding by embarking on unprecedented stimulus packages to keep their economies afloat.

The Chinese are pumping untold trillions into their financial markets and productive economy. The most austere large nation, Germany, casts aside its constitutional prohibition on deficit spending to enact a historic, unprecedented fiscal stimulus package. The free-market Tory government of Boris Johnson has abjured his conservative upbringing if but for this harsh moment. His government is launching a fiscal stimulus unseen in the UK for decades. Likewise, the Bank of England vows to pump as much money into the financial market as is needed to unfreeze it and get it working again.

The conservative Trump government also abandons its laissez faire ideology in the face of this exigency. Trump wants to give 2 trillion in fiscal stimulus and this will likely be just the first tranche. The Federal Reserve has announced an aggressive monetary policy to bolster the financial sector. This is atop the two trillion the Fed already promised.

In the end, do not be surprised if the US government injects over five trillion new dollars into the economy in the months to come. This would represent 25 per cent of last year’s GDP for that nation. Moreover, the US economy is also enacting various forms of debt moratoria such as forbearance on rental payments for struggling families and small businesses to tax relief of various types for companies large and small.

This is truly an eye opening endeavour based on lessons learned from the 1929 Great Depression when government failed to appropriately act and the 2009 Financial Crisis when governments acted in time.

The lesson learned is that a government has the sovereign power and requisite duty to intervene in the economy in order to stave calamity. To aid in this task, a government has the unlimited ability and again public duty to issue as much of its own currency as needed to quell shortage and buffer the populace from hardship.

We, fortunately, are not at the stage where we need to implement such strong economic measures; however, we should be preparing a response for that urgent moment may fall swiftly upon us. In doing so, we must be guided by the same lessons other nations have followed. When it comes to expenditures that can only be made in dollars, we must be extra careful. Dollars now come at a steep premium. However, when it comes to expenditures that can be made in naira, government cannot afford to be bashful or reticent when the need arises.

Already, the price of oil has fallen to less than 30 dollars a barrel. This will bring a dollar shortfall. This does not, however, necessitate a corresponding shortfall in public sector naira expenditures. The US controls dollar issuance. We control naira issuance as is our sovereign right. Just as America has used its sovereign right to issue its currency to stave economic disaster, so too may Nigeria issue naira for the same purpose.

While individuals, companies and even state governments can go bankrupt during hard times, the federal government cannot become naira insolvent because it has the ability to issue our national currency. He who holds the printing press is never insolvent. The most serious concern and limitation on federal naira spending is not insolvency but inflation. Consequently, should circumstances require increased spending, we should not hesitate to do so; but we must keep the watchful eye to ensure inflation does not climb too high. However to save both lives and livelihoods during a moment of historic emergency, a touch of extra inflation from enhanced government spending is a small price to pay. In fact, it is a price that must be paid. The alternative may be a harmful deflation which historically has proven more difficult to tame and cure than a small inflationary increase.

In all of this, the international financial institutions such as the IMF and World Bank must be cooperative and forward-leaning. These institutions must discard their mainstream orthodoxy of fiscal austerity which will straitjacket and injure nations like ours. They must encourage nations to engage in economic stimulus. Moreover, they must suspend debt repayments for poor and developing nations and begin to fashion a plan of partial debt forgiveness for indebted nations.

Below are a few preliminary thoughts on the economic action we might take should the coronavirus mortally threaten our economy.

1. MAINTAIN GOVERNMENT EXPENDITURES: The natural instinct will be to reduce spending. Such reductions may be prudent for individuals and households. For government to move in this direction only feeds economic carnage by amplifying economic hardship. Prudent fiscal policy is generally “countercyclical.” As the private sector shrinks, government does more.

At minimum, the federal government must stick to its naira budgetary expenditures. In fact, government should increase naira expenditures by at least 10 – 15 per cent during an emergency.

Allocations to state and local governments should be included in this addition. If not, we risk subnational recessions in important sections of the country.

2. GOVERNMENT PROJECTS: If the virus is largely kept from becoming a widespread public health menace, government should accelerate spending and actual work on key infrastructural projects particularly regarding transportation. This will lower costs while bolstering the economy by generating employment and business activity.

If the virus does become a large-scale public health challenge, more funds should be allocated to the health sector.

3. TAX REDUCTIONS: Government should announce a tax credit or partial tax reduction for companies or firms. VAT should be suspended for the next 2-4 months. This will help lower import costs and protect against shortages.

4. FOOD SECURITY: We need to protect the people from food shortages and high prices. As such, we must quickly improve farm-to-market delivery of agricultural produce. Also, government should initiate a crash programme to decrease spoilage of agricultural produce by construction of storage facilities in local marketplaces in and around major cities and towns throughout the country.

We must establish a strategic grain reserve. Government should help ensure supply by establishing minimum premium price for certain food products.

5. LOWER INTEREST RATES: CBN should lower interest rates to spur borrowing and private sector activity.

6. QUANTATIVE EASING: CBN and other financial regulators should be alert to signs of fragility in the financial markets and banking sector.

The Central Bank should be prepared to enact extraordinary measures should the financial sector exhibit stress. The CBN should be prepared to give banks liberal access to its loan discount window to ensure adequate liquidity within the banking sector. The Cash Reserve Requirement for banks should be revised downward.

Also to ensure liquidity, the CBN should be willing to expand its balance sheet and improve liquidity by purchasing government bonds and other instruments held by banks and other institutions.

The Nigerian stock market is falling. CBN and others should be planning how they might intervene to prevent a potential run on the stock market. Potential measures include expanding Quantitative Easing to enable the Central Bank to purchase strategically important instruments trading in the stock market and instituting a moratorium on margin calls.

7. EXCHANGE RATE: The Corona crisis will shrink the inflow of dollars. Hopefully, this is temporary, no more than a few months. CBN can allow some downward pressure on the naira without energetically intervening to defend the exchange rate. Only if and when the rate seems that it might dip precipitously should the CBN intervene.

The Bank may want to revisit its decision prohibiting non-institutional Nigerian dollar holders from participation in Open Market Operations. Greater leniency will bring more dollars into the CBN.

8. DEBT SUSPENSION: If economic trouble does come, government must be willing to freeze payment of certain consumer-related private debts. Evictions, foreclosure and light and water cut-offs might have to be suspended. Suspension or partial reduction of payment of school fees for our most indigent families must be considered (that is when schools reopen) while government offers temporary support to the schools themselves.

9. INCREASE STIPENDS TO THE POOR: We must be ready to increase stipends to the poor. We do this by widening the net, substantially increasing the number of recipients of anti-poverty stipends.

In conclusion, I proffer these measures not as some comprehensive solution. I hope these ideas spark needed dialogue about the ways we may need to employ to protect our nation from assault by the coronavirus. I do not know if such a confrontation shall come. What I do know is that wise preparation will carry us close to victory. Unity, compassion and brave implementation of good policy will take us the rest of the way home.

We shall not go down. We shall rise