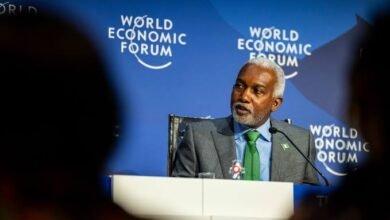

By all accounts, Nigeria’s economic managers, led by Wale Edun, the Minister of Finance and Coordinating Minister of the Economy, have faced monumental challenges in their bid to transform a beleaguered economy. The historic lack of productivity, compounded by inefficiencies, corruption, and unsustainable fiscal policies, created a system that stagnated growth and stifled investor confidence. Yet, 2024 has proven to be a watershed year—defined by difficult but necessary decisions aimed at reengineering the economy for long-term stability and growth.

The reforms enacted by the administration of President Bola Tinubu, though uneasy, are already yielding measurable results, rekindling hope for a brighter future.

For decades, Nigeria’s economy was marred by two fundamental issues: an arbitrary foreign exchange (FX) regime and a heavily subsidized fuel system. Both policies perpetuated corruption, discouraged investment, and drained national resources. Recognizing the unsustainability of these frameworks, the Tinubu administration, under the leadership of Edun, has undertaken two pivotal reforms: the unification of exchange rates and the removal of fuel subsidies.

The government’s decision to harmonize the FX rate marked a seismic shift in Nigeria’s economic strategy. For years, the multiple exchange rate system allowed for rent-seeking and corruption, with insiders exploiting arbitrage opportunities while creating uncertainty for investors. By collapsing this fragmented structure into a unified system, the benefits have been both immediate and transformative.

A unified exchange rate has simplified currency transactions, creating a transparent system that businesses and individuals can easily navigate. This clarity fosters trust and confidence, making Nigeria a more predictable and stable destination for foreign investors. With reduced uncertainty and a clear framework for engagement, investors have been more willing to re-enter the Nigerian market, reversing a trend of capital flight.

The removal of arbitrage opportunities has also significantly reduced rent-seeking behaviors, curbing corruption that previously drained the nation’s resources. Nigerians abroad, seeing a favorable exchange regime, have increased their remittances, providing much-needed inflows that bolster the economy. This alignment of the Naira with market realities has also strengthened the Central Bank’s capacity to implement effective monetary policies, equipping it to better manage inflation and support economic growth.

Perhaps no reform has been as contentious as the removal of the fuel subsidy—a system that, while intended to reduce costs for Nigerians, became a sinkhole for public funds. It siphoned billions of dollars annually, much of which was lost to corruption and fuel diversion to neighboring countries. Eliminating this subsidy has freed up significant resources, redirecting funds to critical sectors.

The immediate impact is already visible at the grassroots level. State governments, previously constrained by dwindling allocations, are now better equipped to deliver public services. For instance, Zamfara State, which once received between ₦800 million to ₦2 billion in monthly FAAC allocations, now receives upwards of ₦10 billion in a single month. These increased revenues have enabled state governments to invest in healthcare, education, and infrastructure, creating a ripple effect of development that directly impacts citizens’ lives.

The combined effect of these reforms is a more stable economic environment, which is crucial for attracting foreign direct investments (FDIs). President Tinubu’s administration has already secured commitments totaling over $30 billion in FDIs. This significant inflow spans sectors such as telecommunications, oil and gas, and renewable energy.

Among these investments, ExxonMobil has committed $10 billion to expand Nigeria’s deepwater oil production, signaling renewed confidence in the oil sector. Indian business conglomerates pledged $14 billion during Tinubu’s visit to India, with Indorama committing $8 billion to expand its petrochemical and fertilizer plant. Similarly, Airtel has earmarked $800 million for network expansion and has begun construction of a $500 million data center in Lagos.

These commitments are not mere announcements; they reflect a growing global confidence in Nigeria’s economic trajectory. Investors are responding to the transparent and stable policies being implemented, confident in the long-term prospects of the Nigerian market. These are wins for Mr. Wale Edun, whose leadership of the country’s economy is proving to be a fitting choice.

And the effects of these reforms are becoming evident, as highlighted in President Tinubu’s Independence Day address. Nigeria’s economy grew by 3.46% in the third quarter of 2024, up from 2.54% in the same quarter of 2023. This remarkable improvement reflects the resilience of the economy and the effectiveness of the government’s deliberate policy choices.

Furthermore, the country’s foreign reserves have climbed to nearly $42 billion, providing a robust buffer against external shocks. This growth in reserves, possible due to the closing of leakages by the government, is crucial for maintaining economic stability and protecting the Naira from global market volatility.

Additionally, Nigeria’s trade surplus now stands at ₦5.8 trillion, indicating an increase in exports driven by rising production and a more favorable business environment. This surplus is a testament to the recovery of key sectors and the benefits of policies designed to promote local production and reduce import dependency.

Together, these indicators demonstrate that the economy is on a path of gradual recovery, driven by transparency, fiscal discipline, and strategic planning.

The reforms enacted in 2024 represent the beginning of a new chapter for Nigeria. By stabilizing the economy, fostering transparency, and attracting investments, the Wale Edun led economic team is laying the foundation for sustainable growth. This period may feel like the tunnel, but the light at its end is growing brighter.

Mr. Wale Edun’s team deserves commendation for their resolve and focus in steering the economy through turbulent waters. Their actions are not just about fixing what was broken but about building an economy that works for all Nigerians.

2025 holds the promise of an Eldorado—a Nigeria where tough decisions made today birth prosperity, equity, and opportunity for generations to come.

John Olanipekun is an Economist and writes from Osun State.