The Federal Inland Revenue Service is becoming more than a government agency. It is not today that we have been saying this, and it will not stop today or anytime soon. It is now being recognised partner in national development, driven by reforms that place people at the center and deliver measurable results.

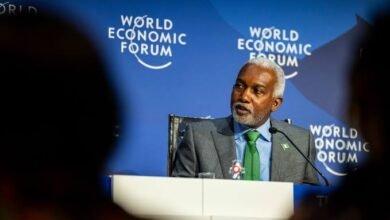

Over the past months, the leadership of Dr. Zacch Adedeji, Executive Chairman, FIRS, has introduced a series of people-focused changes that have shown a tangible impact on our revenue system and the economy at large. His work has been based on practical reforms in tax law, improved welfare for staff and citizens, the adoption of technology to streamline processes, stronger teamwork across departments, and a leadership style grounded in clarity, accountability, and measurable outcomes.

Just this August, the agency launched an electronic invoicing system for companies with an annual turnover of five billion naira or more. It went live on the first day of the month, and by the second week, about a thousand companies had already joined. Organizations like MTN, Huawei, and IHS are on board. Others have until November 1 to comply. The process is firm, but the rollout has been managed carefully, giving companies enough time to adjust without disruption.

The effects are already showing. Afri Invoice, a local Nigerian company that provides e-invoicing solutions, has created 150 new jobs in seven states to meet the demand. It may seem small, but it serves as proof that one effective policy can open the door to more jobs and economic growth.

Not long after, on August 7, FIRS held its first Research Day. It was not an event for long talks but a day of action and openness. Three main resources were made public. The first was the Tax Revenue Statistical Bulletin, containing more than fifty years of tax data from 1970 to 2022. The second was the official Research Policy, which sets out a framework for conducting transparent and high-quality studies. The third was the latest volume of the FIRS Journal of Tax Studies, now available online. These materials are open to researchers, journalists, students, policymakers, and anyone who wants to understand our tax history and the direction we are headed.

Step by step, these reforms show that when leadership is focused on people and guided by data, institutions can transform. The work being done at FIRS today is building not only better systems but also trust between the government and the people it serves.

Let’s not forget that under the Tax Boss, tax education and public engagement have also taken a new shape. FIRS has stepped up its outreach to small and medium enterprises, offering guidance on compliance and breaking down processes that once felt complicated and far removed from the everyday business owner. The agency has also strengthened partnerships with state revenue services, ensuring that both federal and state systems work together rather than compete.

Capacity building for staff has been prioritised, with training programs designed to give them the skills and tools to meet modern tax administration demands. In addition, reforms in dispute resolution have made it faster and easier for taxpayers to settle issues without lengthy court battles, promoting a more cooperative relationship between the agency and the general public. Digital platforms have been improved, meaning that many taxpayers can now register, file, and pay from the comfort of their offices or homes.