By Nnamdi Chukwuemeka

The Federal Government launched the Trader Moni scheme as part of the Government Enterprise and Empowerment Programme (GEEP) in July 2018. The TraderMoni scheme entails the provision of N10,000 in interest free credit to table top traders. Beneficiaries have up to six months to repay the loans and thereby qualify for higher sums of money.

Since the launch of the scheme, which has been received by great enthusiasm by the beneficiaries, there have been various reactions ranging from genuine interest in knowing how the scheme works to name calling by political opponents of the APC Government who have called the loans bribes and vote-buying. It is difficult to understand how money that will be paid back can be considered as bribes. This short paper outlines the economic case for the TraderMoni scheme and the benefits that it will entail for the country.

The starting point for understanding TraderMoni is to see it as part of the broad ranging financial inclusion strategy of the Federal Government. Financial inclusion entails making financial services available to households and businesses in an affordable way. Several studies have shown that access to financial services helps to reduce poverty by facilitating payments and savings for households and businesses as well as enabling households to smooth out expenses and access services like micro-credit, micro-insurance and pensions.

It also helps to improve lives, spur economic activity, reduce the cost of financial transactions and improve the delivery of social services, especially government payments. Financial inclusion also helps micro-enterprises to access cheaper credit and invest in order to grow their businesses.

Financial exclusion is considered expensive for economies. This means that with up to 41% of Nigerians lacking access to formal financial services there is need for urgent action. Financial exclusion in Nigeria is quite high compared to countries like Ghana where the rate of financial inclusion increased from 29% in 2011 to 58% in 2017. In South Africa which still suffers from the legacy of apartheid, up to 75% of the population has bank accounts as compared to 46% in 2004. In Kenya there has been a drastic increase in financial inclusion with up to 75% of the population having bank accounts, which is a 50% increase over the past 10 years partly due to the impact of digital payments systems. The common denominator in the examples of South Africa, Ghana and Kenya is that their governments took innovative and urgent action to speed up the pace of financial inclusion.

Empirical evidence from random controlled trials shows that small businesses benefit from increased access to credit because it enable them to invest in assets to expand their businesses, diversify into new products and cope better with business risk. Indeed, the relatively longer tenor of TraderMoni loans means that small entrepreneurs can venture into expanding their inventory and/or production.

Given Nigeria’s relatively poor performance in financial inclusion, the Federal Government has taken a strategic and innovative approach to ramping up financial inclusion in Nigeria. It has done this by:

- Recognising the need for urgency

- Introducing innovative programmes

- Using fintech

- Working with major stakeholders

In recognising the need for urgency, the Federal Government to an approach to financial inclusion that would bring a large number of people into the financial net in a very short space of time. Accordingly, its target for TraderMoni was to have 2m people engaged in the scheme by the end of 2018. In the same vein, the programme ensured geographical coverage so that each State would be entitled to at least 30,000 participants in the TraderMoni scheme in the first phase.

The innovative programmes introduced to boost financial inclusion are to be found in the Government Enterprise and Empowerment Programme (GEEP) which provides micro-credit to existing businesses, which means the focus in on empowerment. GEEP has several components such as TraderMoni, MarketMoni and FarmerMoni and involves giving interest free loans to existing businesses. The advantages of the GEEP programme are exemplified by Trader Moni whose features include:

- N10,000 loans

- The credit is interest free

- Participating traders have to be table top, bottom of the value chain micro enterprises

- These micro-enterprises have to be carefully enumerated and captured into a database

- The loans have to be repaid in six months which entitles the borrower to borrowing a higher amount of N15,000

MarketMoni which grants loans from N50,000 to N300,000 requires participants to open or have bank accounts (immediate financial inclusion) also uses an innovative risk mitigation arrangement whereby participants have to be part of a cooperative in order to qualify for the credit.

Studies have shown that microcredit works well when the participant already has an existing business and when interest rates are not exorbitant. TraderMoni meets this requirement given that participants not only have existing businesses but they are actually part of established retail chains, albeit at the lowest end. The interest free credit is to be contrasted to interest paid on loans from microfinance banks which attract interest rates of up to 30% to 60%.

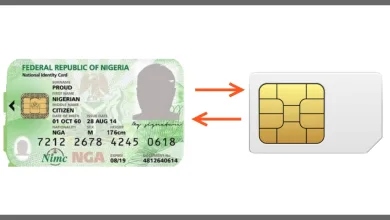

TraderMoni also supports financial inclusion because it is bringing two million people into the financial system. Participants get paid by electronic cash transfers and are required to open bank accounts including KYC requirements and BVN at point of requesting additional loans. This innovative micro-credit scheme will also help to avoid dependence on unreliable, insufficient and expensive informal mechanisms which traders currently rely on.

As a micro-credit scheme, TraderMoni can be seen as a good starting point for wider economic inclusion as the enrolment and data generated will propel the movement towards micro-savings, micro-insurance, micro-pensions and micro-payments for services like health provision. It will also encourage a second generation of innovative business ideas such as micro-leasing for ‘okadas’ and solar power. This will be backstopped by the fintech arrangements being used to process TraderMoni loans such as Eyowo.

Working with the Committee of Bank Chief Executives, the TraderMoni scheme will also be giving telephone hand sets to participants who do not already have one. This will help reduce the resort to sharing handsets and also ensuring that electronic payments get to the intended beneficiaries. The banks are working speedily towards expanding their agent network across the country while also making greater use of technology to ensure interoperable systems. Ultimately, with an envisaged general saving account somewhat like the government saving account in India, financial inclusion will enable more people to access additional services like micro-insurance, micro- payments, etc. TraderMoni is similarly preparing the previously financially excluded to use the Payment Services Banks which are set to be licensed by the Central Bank of Nigeria.

The strategy of using micro-credit and technology contribute to higher degrees of financial inclusion which is positively and causally related to growth and employment. It is estimated for instance that the roll out of SANEF by the Bankers Committee will lead to an additional 500,000 jobs in the wider economy