News

What You Need To Know About The FIRS Taxpro-Max

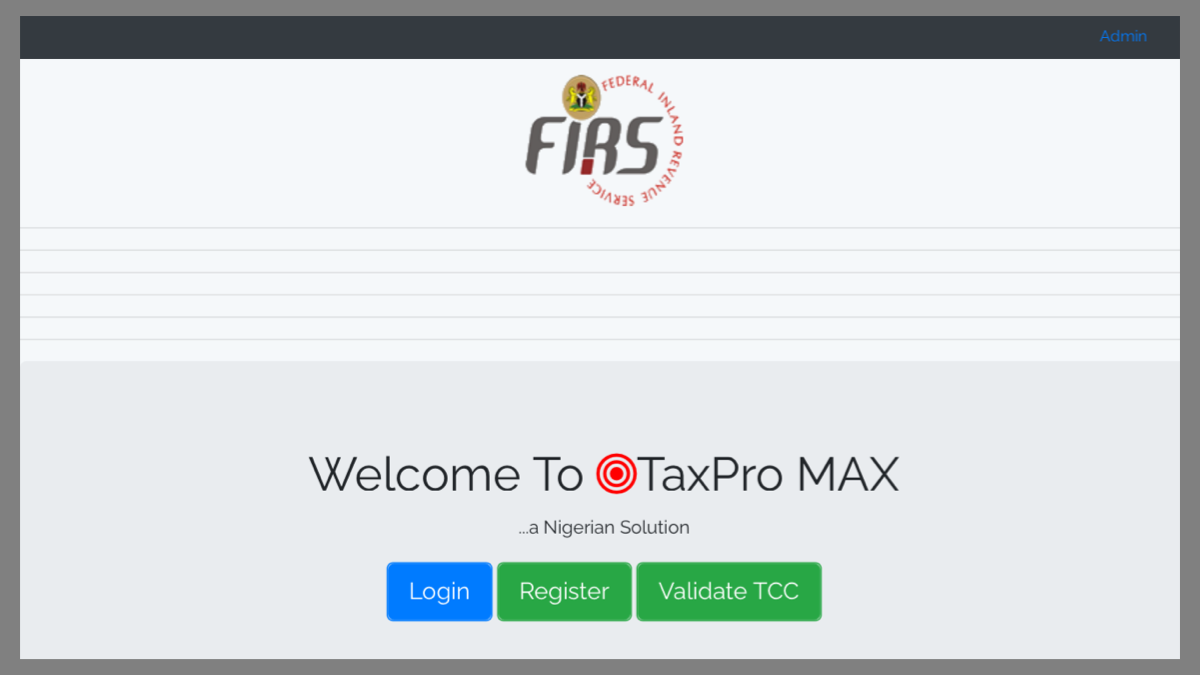

The Federal Inland Revenue Service recently launched a new Tax Administration Solution known as Taxpro-Max.

Survey carried out by PwC on tax payment revealed that 22.5% attribute their non payment to the tax rules that are unclear and compliance process being too complex. Also the immediate past finance minister said that 75% of registered companies were not in the tax net while 65% of those in the tax net do not file returns or pay taxes.

According to the FIRS, the platform is part of its effort modernize tax administration and ease tax compliance from citizens and businesses across the country.

Here is what you need to know about TaxPro-Max

TaxPro-Max is the channel for filing Naira-denominated tax returns in Nigeria

The TaxPro-Max platform allow individuals and business to register, file and pay taxes and automatic credit of withholding tax as well as other credits to the taxpayer’s accounts.

The TaxPro-Max also provides a single-view to Taxpayers for all transactions with the Service.

All Naira-denominated tax returns must be filed via the TaxPro-Max Solution in order to generate the obligatory Document Identity Number (DIN). Taxpayers will not be able to pay without DIN

There is dedicated customer care desk for taxpayers experiencing challenges filling their returns on TaxPro-Max. You can reached them via, taxpromax@firs.gov.ng

TaxPro-Max is integrated with REMITA and Interswitch payment system

If you plan to submit your tax returns manually, you must visit the relevant tax office where FIRS personnel will be on hand to assist them to upload the returns and generate the DIN.

Due to time it will take to upload manual returns and generate DIN (Document Identification Numbers) it is advisable to bring manual returns for upload, at least, two weeks before the due date;

The TaxPro-Max platform is accessible on FIRS website