Few would dispute that the last 19 months have been some of the most economically turbulent in Nigeria’s history. The removal of fuel subsidies and the harmonisation of the foreign exchange market were two long-overdue reforms that sent shockwaves through the economy. Prices skyrocketed, businesses struggled, and ordinary Nigerians bore the brunt of these changes. But despite the immediate hardships, these reforms were necessary steps towards a more sustainable and self-sufficient economy.

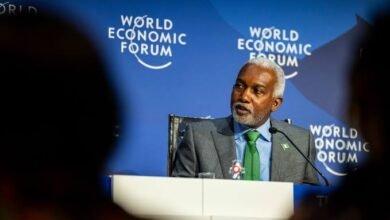

As the Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun emphasized recently, the Nigerian economy is finally on a path to stability and long-term growth. And the data supports his optimism. Inflation is declining, food prices are stabilising, and the Naira has found a more predictable footing. More importantly, the fundamentals of the economy are improving.

The decision to remove fuel subsidies and unify the foreign exchange market was a bitter pill to swallow. For years, the subsidy regime drained national resources while benefiting only a small fraction of the population. It discouraged investment in the oil sector and created an artificial economy reliant on government handouts rather than genuine production. Likewise, multiple exchange rates created distortions that deterred foreign investment and encouraged rent-seeking.

These changes—the removal of subsidies and unification of the exchange rate—led to an initial surge in the cost of living. Transport fares increased, the prices of goods and services shot up, and businesses struggled with rising operational costs. However, facts are showing that the economy is now settling into a more natural state—one where prices are determined by market realities rather than government intervention.

Mr. Wale Edun, in a recent interview with African Business Magazine, highlighted key indicators of that show Nigeria’s economic recovery. The stability of the exchange rate since December is one such sign. For the first time in years, investors and businesses can plan with confidence, knowing that the Naira is not subject to abrupt and unpredictable swings.

Based on data from Exchange-Rates.org, the average exchange rate between the US Dollar (USD) and the Nigerian Naira (NGN) over the past two months has been approximately ₦1,595.49 per $1. During this period, the exchange rate reached a high of ₦1,685.62 per $1 on November 27, 2024, and a low of ₦1,491.37 per $1 on February 3, 2025. This is telling that if anything, the price of the dollar, asides maintaining stability, has in fact been on the downward slope—showing that it is getting stronger by the day.

Another significant development is the decline in fuel prices, a rare occurrence in Nigeria’s history. The presence of multiple refineries—including the Dangote Refinery, the recently rehabilitated Port Harcourt Refinery, and the upcoming BUA Refinery—has introduced long-overdue competition into the petroleum sector. The result? Petrol prices have dropped from ₦1,200 per litre to around ₦940, defying the usual trend of relentless price increases. In fact, today we are seeing petroleum marketers advertise their products? Whoever thought that Dangote Refineries would be running adverts on social media asking people to buy its petrol is telling.

One of the strongest indicators of economic improvement is the reduction in food prices. According to market data food prices have seen a notable decline across key staples, signalling a broader economic improvement. This data reveals a sharp decrease in maize prices, dropping by more than 40 percent per metric ton. Rice, a staple in most households, has seen a price reduction of nearly 20 percent per bag.

Fresh produce has also become more affordable. Tomato prices have been cut in half per basket, making a once-costly ingredient more accessible. The most dramatic decline, however, is in onions, which now sell at just over a quarter of their previous price per sack. These shifts in food costs suggest a stabilizing market, offering relief to households grappling with inflation in recent months.

These price corrections are not accidental. They result from deliberate government policies aimed at improving food supply and reducing import dependence. Increased agricultural production and targeted interventions are beginning to bear fruit.

Another positive development is Nigeria’s growing trade surplus, which now stands at ₦5.8 trillion. For years, Nigeria imported more than it exported, depleting foreign reserves and weakening the Naira. Today, the country is selling more to the world than it is buying, strengthening the economy.

Foreign reserves have also grown significantly, reaching $42 billion as of December 2024. This is partly due to the end of fuel subsidies, which previously drained billions of dollars from government coffers. With more foreign exchange available, Nigeria is now better positioned to defend its currency and support economic stability.

Just last year, Nigeria spent 92% of its revenue on servicing debt. It was an unsustainable situation that left little room for development spending. However, with prudent fiscal management, that figure has dropped dramatically. In the 2025 budget, Nigeria is projected to spend less than 20% of its revenue on debt servicing—a monumental improvement when compared to what was spent some few years back.

This means more resources are now available for infrastructure, healthcare, education, and other essential services that directly impact the lives of Nigerians. Take the examples of states that are now receiving at least five times the allocations they were getting pre-subsidy removal.

Perhaps the biggest sign that Nigeria is on the right track is the renewed confidence of foreign investors. Nigeria’s latest Eurobond issuance was oversubscribed by an astounding $9.1 billion—far exceeding the $2.2 billion initially offered. This is a strong vote of confidence in the economic strategy of the Tinubu administration. Investors are taking note of the stability in exchange rates, the growth in foreign reserves, and the improving macroeconomic fundamentals.

There is no denying that Nigerians are still facing challenges. The economic challenges built over the past two decades will take time and strategic efforts to resolve. But there is now a clear strategy in place, and the early results are encouraging. The Honorable Minister of Finance and Coordinating Minister of the Economy expressed optimism in his recent interview with African Business Magazine stating that the economy is achieving stability, and inflation is dropping. Mr. Wale Edun’s optimism is not unfounded—it is backed by data and a coherent vision set forth by the President.

The journey to economic recovery is like planting a seed. The soil has been tilled, the seed has been sown, and now, we are beginning to see the first green shoots of growth. With continued patience and commitment to reforms, Nigeria’s economic potential can finally be realised. Indeed there is genuine hope for a more prosperous Nigeria. And that is why I share in Wale Edun’s optimism.

Mr. Bernard Okri is the President of the Global Economic Policy Initiative (GEPIn)