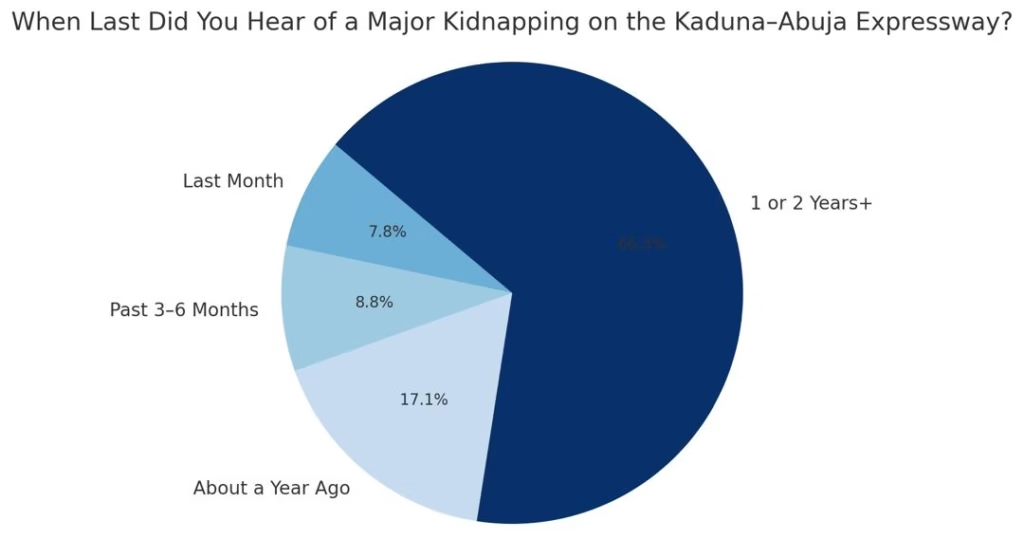

In a recent survey conducted on the social media platform X (formerly Twitter), Nigerians indicated that there have been significantly fewer security incidents on the Kaduna–Abuja Expressway over the past two years.

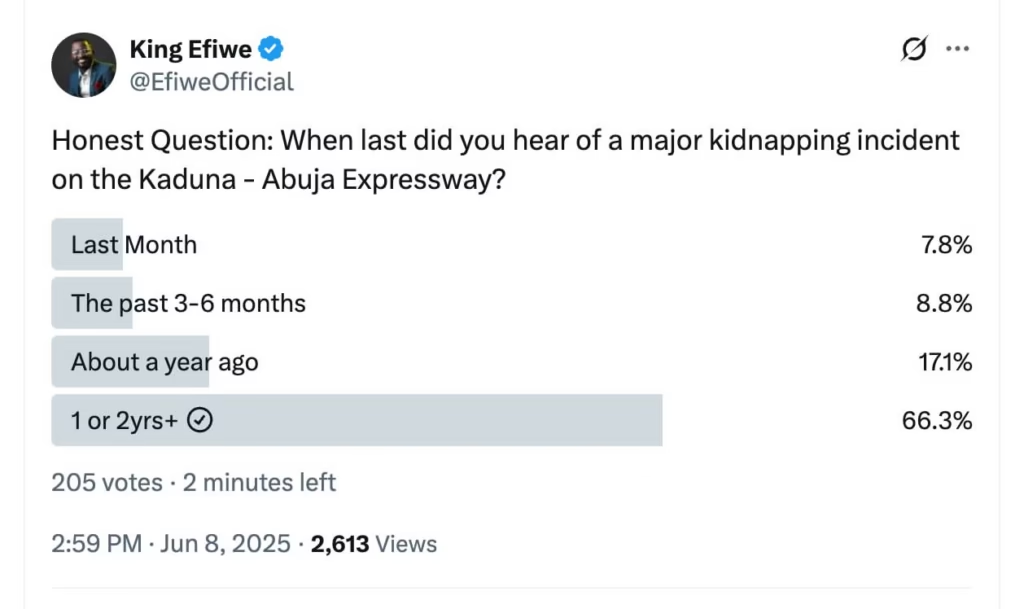

To assess public perception of safety along the Kaduna–Abuja Expressway—a corridor once notorious for high-profile abductions and violent attacks—Mr. Taye Paul Olubayo, a security and media consultant known on social media as @EfiweOfficial, conducted an online poll asking Nigerians:

“When last did you hear of a major kidnapping incident on the Kaduna–Abuja Expressway?”

A total of 205 respondents participated in the poll. The aim was to gauge when the public last became aware of a major security breach on the route. Only 16 respondents reported hearing of an incident in the past one month, while 18 said they had heard of one in the past three to six months. A further 35 respondents indicated they last heard of an incident about a year ago.

The overwhelming majority—66.3% of respondents, representing 136 votes—reported not hearing of any major kidnapping on the expressway in the past one to two years or more.

This significant margin suggests a notable improvement in public perception, likely reflecting enhanced security measures and sustained counter-terrorism operations along the corridor.

It is particularly telling that only 7.8% of respondents reported awareness of a kidnapping incident within the past month—further reinforcing the perception of improved safety and deterrence under the administration of President Bola Ahmed Tinubu.

This shift aligns with recent security gains and operational realignments spearheaded by the Federal Government, especially President Tinubu’s directive for security forces to restore full security across northern Nigeria before the end of 2025.

In a recent public presentation, National Security Adviser (NSA), Malam Nuhu Ribadu, detailed the Federal Government’s aggressive response to terrorist threats and criminal activity across the country since the current administration assumed office.

According to the NSA, over 13,000 terrorists have been neutralised in the past two years, and hundreds of thousands of rounds of assorted ammunition have been recovered and destroyed.

Speaking on the often-unseen nature of the work being done by his office and security agencies, Ribadu noted:

“We do not talk much because of the nature of the work we are doing. Most of these things have not been made public. That’s why we are taking our time to use this opportunity to bring the facts and figures so that people will know.”

He further stated that, through enhanced intelligence gathering and inter-agency coordination by the Office of the National Security Adviser, major security flashpoints—including the Kaduna–Abuja Expressway—have now become safer for both travel and residence.

“Let me reiterate that significant gains have been recorded in addressing Nigeria’s complex security landscape since May 29, 2023,” he said.

“We have enhanced security operations, improved intelligence gathering, and targeted interventions that are stabilising key hotspots and reducing casualties.”