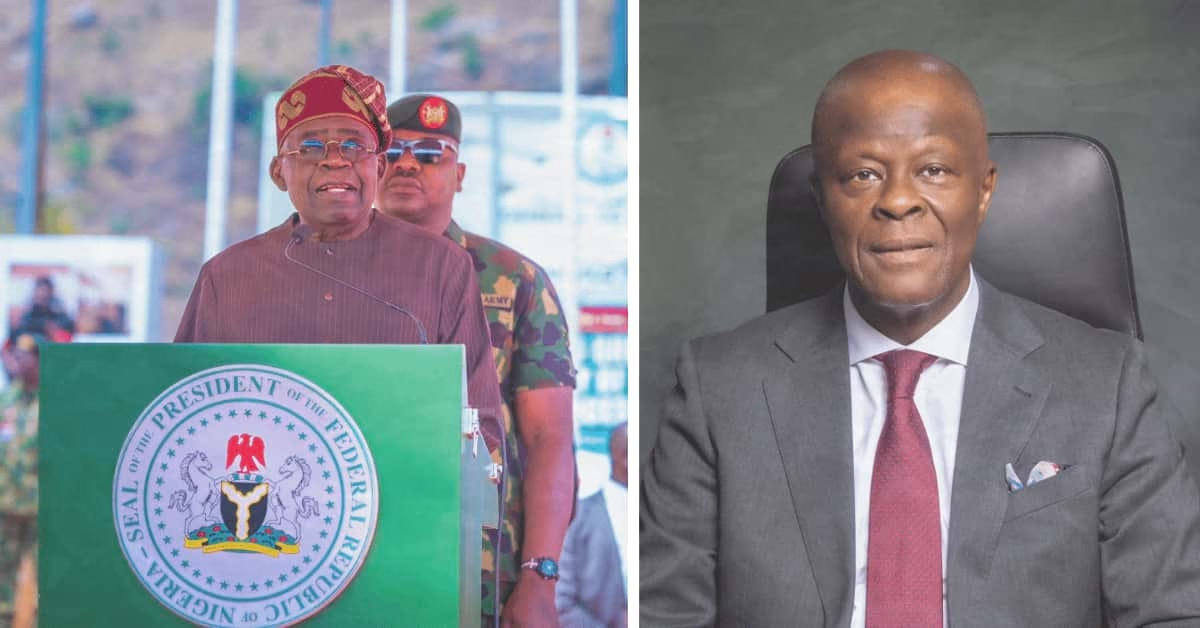

Nigeria’s stock market is witnessing its most impressive performance under any civilian administration since 1999, with analysts crediting the rally to sweeping economic reforms under President Bola Ahmed Tinubu and the steady guidance of his economic team, led by Mr. Wale Edun, the Minister of Finance and Coordinating Minister of the Economy.

According to a recent analysis by Nairametrics, the Nigerian All-Share Index (ASI) has soared by a remarkable 136% since President Tinubu assumed office in May 2023. The ASI rose from 55,769.28 points on May 29, 2023, to over 131,000 points by mid-July 2025—marking a historic milestone for the Nigerian Exchange (NGX).

This is the highest stock market gain recorded at this stage of any Nigerian presidency since the country’s return to democratic rule.

In terms of market capitalization, the NGX has grown from approximately ₦30 trillion in May 2023 to over ₦75 trillion today which amounts to a staggering ₦45 trillion increase.

Although some of this growth may be tempered when adjusted for exchange rate depreciation, the scale of expansion remains unprecedented, especially given Nigeria’s complex macroeconomic environment. For context, at a similar stage in previous administrations, the market saw far more modest gains—or losses: 4.47% under Buhari in 2016, 47% under Jonathan in 2013, and a 49% market crash under Yar’Adua. Only Obasanjo’s tenure comes close, with a 115% gain by July 2001.

Driving this bullish run is a wave of reform led by President Tinubu and implemented through the fiscal and monetary policy frameworks overseen by Mr. Edun.

From the removal of fuel subsidies to foreign exchange unification, Edun has played a central role in crafting policies aimed at restoring investor confidence, cleaning up public finances, and fostering a more efficient market economy. Despite their inflationary effects, these tough but necessary reforms have earned praise from international institutions and market participants alike.

Key reform-driven catalysts include the Central Bank’s bank recapitalization drive—which is expected to raise over ₦5 trillion by 2026—and improved liquidity in the economy as FAAC allocations surged following the subsidy removal. With limited speculative opportunities in the forex market, many investors are turning to equities and fixed-income instruments.

High interest rates (MPR at 27.5%) have also helped channel funds into financial markets, while improved corporate earnings across banking, ICT, industrials, and agriculture have sustained investor enthusiasm. Notably, the banking sector alone has added over ₦7 trillion in market value, led by institutions like GTCO and Zenith Bank. In ICT, MTN Nigeria and Airtel Africa have recorded combined gains of over ₦4.8 trillion.

The domestic investment community has played a critical role in this rally. In Q1 2025, domestic investors accounted for 63.63% of the ₦2.23 trillion total market turnover. Between May 2023 and May 2025, domestic participation in equity trading hit ₦9.375 trillion—roughly 81% of total market activity.

This shift underscores growing local confidence in the economy under Tinubu and Edun’s stewardship. Recent and anticipated listings, such as Aradel Holdings (₦2 trillion gain) and upcoming IPOs by Dangote Fertilizer and NNPC, are also expected to keep sentiment buoyant.

While the equities boom is a strong signal of investor confidence, challenges still persist for everyday Nigerians who are still facing inflation and rising living costs. Nevertheless, for market analysts, the evidence is clear: Nigeria’s capital markets are undergoing a renaissance, driven by reform-minded leadership. As the second half of 2025 unfolds, there is cautious optimism that the gains in market confidence can translate into broader economic impact—anchored by the fiscal discipline and policy clarity provided by Mr. Wale Edun and his team.

– John Olanipekun is a public commentator and Economist