By Adeyemi Dipeolu

I have hesitated to weigh in the media frenzy about the HSBC report entitled ‘Nigeria: Papering over the cracks’, which was issued in July 2018. My hesitation had to do with the fact that I had not read the full report in its original form and could not therefore make any meaningful comments on its contents.

I have since read the report and since there is still quite a bit of interest and chatter about its contents, I feel that it is appropriate to respond to these, as well as to its handling by the Nigerian media.

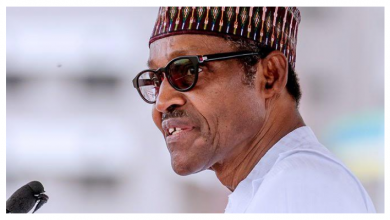

The first thing that strikes one after reading the report is that the writer downplays positive developments in the Nigerian economy. Every time that the data points to improvements in the Nigerian economy, the writer then immediately makes a negative assessment. For instance, he acknowledges a current account surplus, exchange rate stability, declining inflation, improved capital flows, amongst other things, and then concludes that because of structural shortcomings, the long-term prospects for the economy are poor.

When the HSBC report notes that the structural constraints of the Nigerian economy are long-standing, one would have expected the analysis to include the on-going efforts to tackle such constraints. Identifying ‘inadequate infrastructure, corruption, an inefficient government bureaucracy and policy instability…’ as evidence of structural shortcomings is not new.

However, balanced analysis would then seek to establish if such problems were being tackled as priorities and reflected in the actions of the Buhari Administration. The Economic Recovery and Growth Plan (ERGP) is readily available and there is no shortage of evidence about the on-going extensive investments in power, road and rail infrastructure, the active anti-corruption actions of government and on-going re-positioning of the public service.

Similarly, the writer acknowledges that the World Bank ranked Nigeria as among the 10 countries implementing the most regulatory reforms to make it easier to do business, but he would rather place emphasis on the current low ranking of being 145 out of 190 countries, than on the fact that this reflected a movement of 24 places in one year! This inexplicable desire to overlook the positives in favour of negative analysis is worsened by the tendency of the writer to contradict himself or deploy inaccuracies in favour of his conclusions.

Let us look, for instance, at the discussion about the contribution of the non-oil sector. If the non-oil sector accounts for 90 per cent of the economy, how can one legitimately speak about a lack of diversification? Analysis of this nature needs to be more nuanced. The point really is that diversification is needed more in terms of the sources of government revenue and foreign exchange, a problem that the ERGP seeks to tackle.

It is this lack of context that leads the writer into logical inconsistencies. Otherwise, how can the report acknowledge that higher oil prices should provide some support for government revenues and then go on to say that “debt is low. But revenues are lower still.” In addition to potentially increased oil revenues, it would have been important to take account of the efforts to boost non-oil revenues through on-going increased collections by the Federal Inland Revenue Service (FIRS) and the Nigerian Customs Service (NCS), which are in the public space.

The analytical weaknesses of the paper are further exposed in several other instances. For example, if the PMI, a forward looking indicator, has been improving and is not matched commensurately by GDP growth figures, then a reflective analyst should be intrigued about the seeming misalignment in these two sets of figures, rather than immediately jump to negative conclusions. Also, how does one acknowledge the ‘benefits of higher oil prices and production’ and then go on in the same report to say that ‘militant activity has disrupted oil production in the Niger Delta’? Everyone knows that the active engagement of the federal government, especially the role played by the vice president has substantially calmed things down in the Niger Delta. Perhaps the writer of the HSBC report forgot to update this information when ‘cutting and pasting’ from a previous report?

In terms of economic analysis, I must say that it is difficult to understand what the HSBC report has in mind when it states that Nigeria’s macroeconomic “gains merely mask the economy’s unresolved structural shortcomings”. Surely, the entire purpose of macroeconomic gains in an economy such as Nigeria’s is to provide an enabling environment and lay a foundation for structural change, which is exactly what the ERGP sets out to do.

To conclude, while the economy has not yet reached desired growth levels, there are positive developments in macroeconomic conditions, the real sector, the business environment, social investments and infrastructure that will underpin and give further impetus to achieving the primary goal of the ERGP which is sustained inclusive growth.

Adeyemi Dipeolu is special adviser to the Nigerian president on economic matters.